Unlock your purchasing power with VAT funding

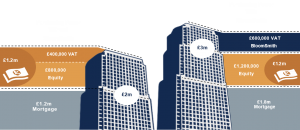

Unlock your purchasing power with VAT funding Leveraging VAT funding to buy larger commercial premises How you can turn £2 million into £3 million of

Unlock your purchasing power with VAT funding Leveraging VAT funding to buy larger commercial premises How you can turn £2 million into £3 million of

Google’s most asked questions about VAT bridging loans Bringing clarity to commercial property VAT payments BloomSmith is the leading provider of commercial VAT bridging loans

This month new Government legislation has been issued, effective 1st September 2021, enforcing significant change to the use classifications for commercial property and land. Classes

VAT funding is an innovative financing model that enables you to tackle the challenges that large VAT payment on a commercial property purchase can create.

Nigel Smith explains the (almost) inevitable SDLT payment needed on your commercial real estate purchase and why VAT makes a difference to the amount of

Loan to Value (LTV), why VAT makes a difference and how BloomSmith can solve the LTV – VAT problem. Getting the LTV right is vital

At BloomSmith, our market leading expertise is driven by experience and collaboration, particularly with our valued network of accountants. So, as we draw to the

MP’s have finally managed to make a decision of note and not one of detail. In the first December election since 1923, when, interestingly, Labour

As BREXIT continues to weigh heavily on an increasingly one dimensional media narrative and the health of the UK Economy in general, Real Estate developers

Get our latest news and knowledge delivered straight to your inbox

Subscribe now

By Signing up you confirm we can use your email address for marketing. More info can be found here